how to take an owner's draw in quickbooks

Recording an Owners Draw 3. You have a lot of love for your business but you also know that love doesnt pay your bills.

How To Record An Owner S Draw The Yarny Bookkeeper

This is where youll take artificial intelligence to enable and inspire humans to do more and be better.

. Pay yourself the right way. We will cover everything you need to know about the purchase order approval process. In this article we will cover 4 common approval templates you can leverage to set up an effective purchase approval process.

Im a sole member LLC. In addition the Owners operations staff familiarizes itself with operational requirements before taking over the systems and placing the asset into service for its intended use. Using Reminders and Setting Preferences 5.

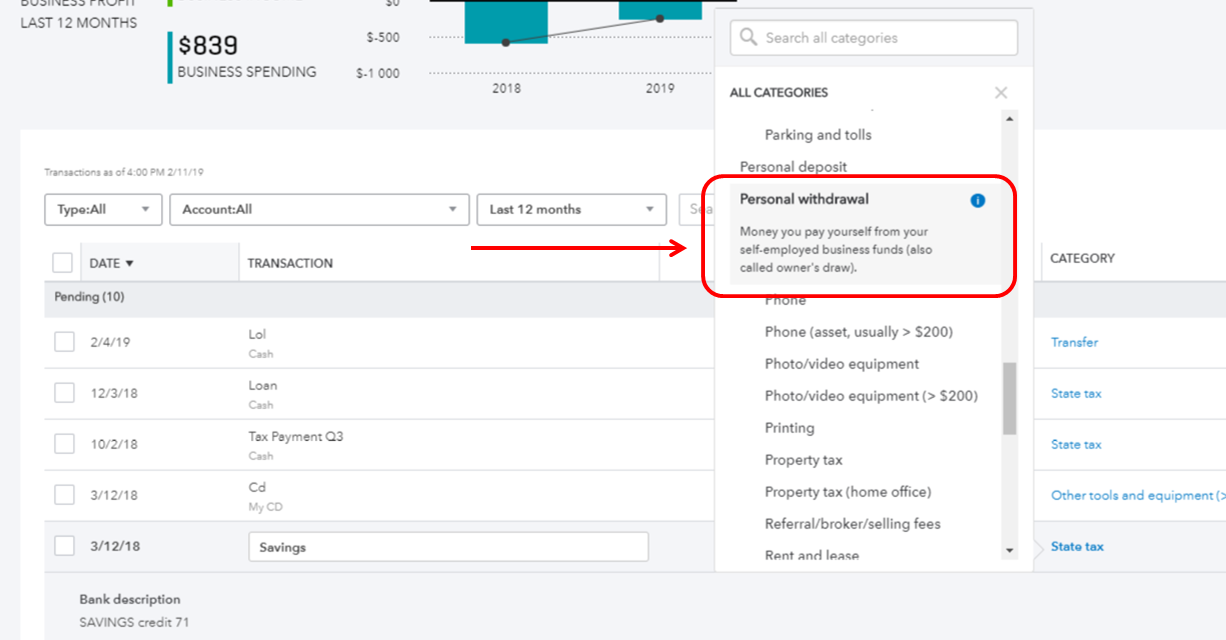

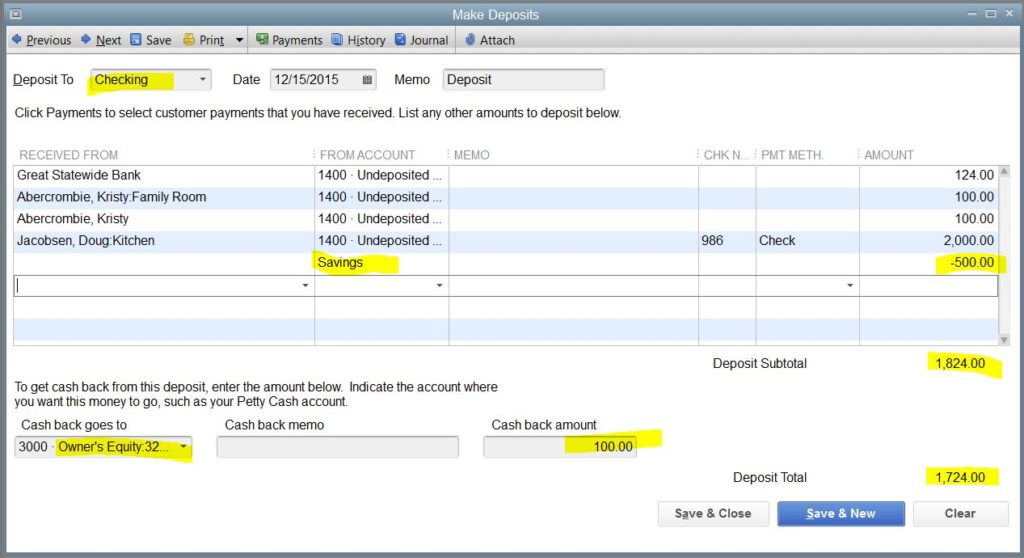

The most common way to take an owners draw is by writing a check that transfers cash from your business account to your personal account. Learn how to calculate owners equity plus examples. Lastly if youre using a for-profit accounting product like QuickBooks you may run into some troublesome issues as you dive deeper into true nonprofit accounting.

No one else is accomplishing what were doing with data-driven AI right now. This course provides an overview of the use of information technology in an accounting environment. In that case there should be few problems with payments.

Plus draw measurements annotate and tag photos so that you always know every detail at every moment wherever you are. She has been in the accounting audit and tax profession for more than 13 years working with individuals and. Earnings available for common shareholders.

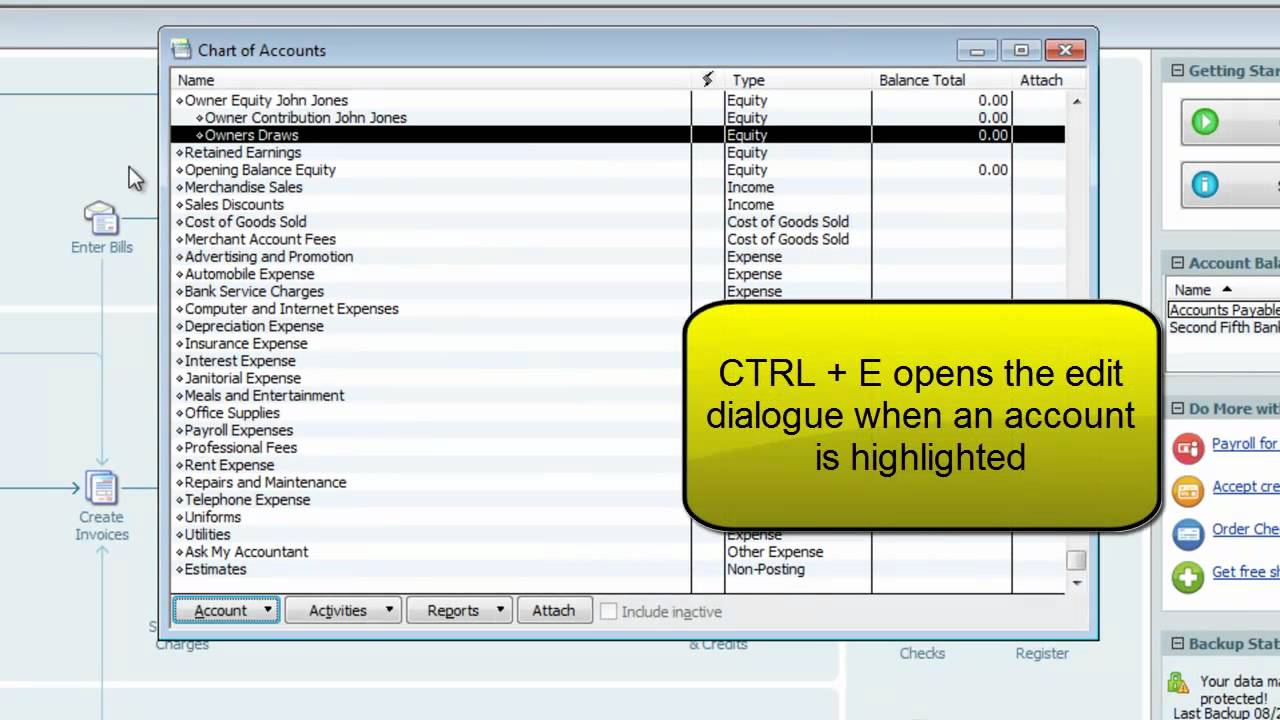

I prefer to setup a credit card type account in QuickBooks called Owed to Owner or you could substitute their actual name. This is any salary for the business owner which comes out of company revenues. Accounting Principles - Standalone book 12th Edition by Jerry J.

A good draw schedule strikes a reasonable balance between the builders need to get paid on time and the owners and banks need to pay only for work completed. Our people our customers and our investors agree. The draws are however subject to a 153.

Since this leg is half of the chord the total chord length is 2 times that or 9798. To apply for forgiveness for your second draw loan you must have completed the forgiveness process for your first draw loan. Quickbooks QuickBooks.

Learn more and Apply. Watch the short video below to get a step-by-step walkthrough. Using the To Do List 4.

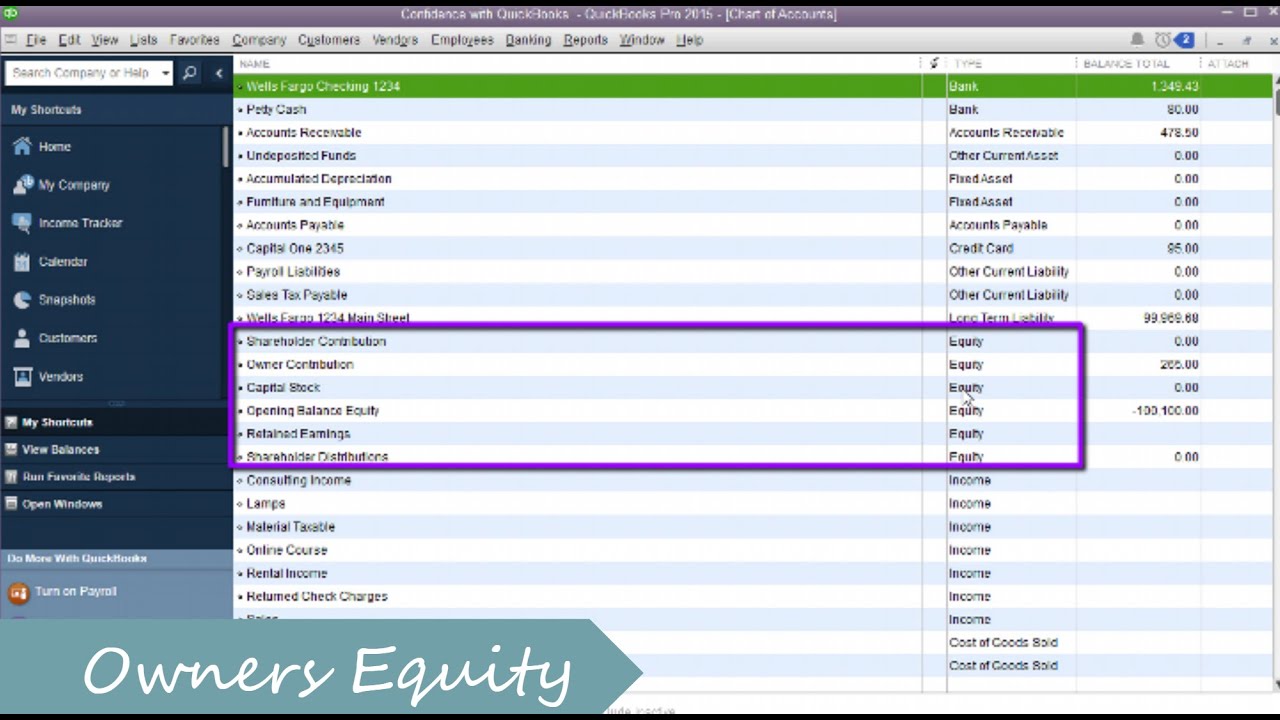

If they dont take the money out I think they are hurting themselves by inflating profits artificially and paying more taxes later. Owners equity is the amount a stakeholder has left if all the assets of the business were sold today. An owners draw doesnt affect your taxes but merely reduces your capital investment in the company.

Using the Letters and Envelopes Wizard 2. Kieso Author Free Education for all. Kimmel Author Donald E.

They provide the most accurate aerial measurement reports available for the entire outside envelope of a home or business and use those reports to. Is it a sits in salaries payable b move to owners contribution c If they are also taking draws will you net against it. Setting Up Budgets 3.

The key is to have a payment plan that is based on an accurate budget fair to all parties and easy to follow. Contributions are tax-deductible if the annuity is a qualified annuity and investment earnings grow tax0-free until the annuitant begins to draw income from them. When I want to take money from the company I created an Owner Draw equity ac.

We will discuss all types of transactions learn how to use accounts properly and take a look at other details you will want to record. What is the Balance Sheet Impact. Specifically The key steps in the purchase approval cycle and how to identify your companys process.

Owners equity is also where a family living or draw account would be located if the business is providing for personal needs of the owners and an owners contribution account to capture contributed capital situations. Most annuities offer tax advantages. An owners draw can also be a non-cash asset such as.

Making General Journal Entries 6. Ebony Howard is a certified public accountant and a QuickBooks ProAdvisor tax expert. Topics include an introduction to selected hardware and software concepts system design and various software applications.

Although sometimes defined as an electronic version of a printed book some e-books exist without a printed equivalent. Recording a Capital Investment. Paying yourself an owners draw in QuickBooks is easy.

Click to get the latest Buzzing content. Then you need to record the entry to debit Owners Draw or Owed to Owner account. As the business owner you need to pay yourself to cover your personal expenses and justify the time.

If your company has investors or if you take a salary from the company this line is important because it shows a net after-tax profit minus any dividends for preferred shareholders. Viewing Your Company Information 2. Accounting and Information Technology Course Description.

If youre using an accounting program like QuickBooks you want to look for an owners equity account called something like dividends or distributions or draws to use for shareholder dividend or distribution payments. Writing Letters With QuickBooks 1. Weygandt Author Paul D.

Ive got an Owners Equity equity account set up and any time I Take money from my pocket and spend it on the company I log it in this account and categorize it properly for tracking purposes. Draw a segment perpendicular to the chord from the center and this line will bisect the chord. Students will gain an.

An ebook short for electronic book also known as an e-book or eBook is a book publication made available in digital form consisting of text images or both readable on the flat-panel display of computers or other electronic devices. Scope Technologies sells tools that make contractors more efficient. Transforming our data-driven world takes talent and MindBridge is where its happening.

With a sole proprietorship you can pay yourself a draw as often as you want. Similarly if the company pays for an owners health insurance that amount should also be excluded from Schedule A Line 6. Subcontract A Subcontract is a legal agreement where a party on a prime contract engages a third-party the subcontractor to perform all or part of the work defined.

Setting up the Pythagorean Theorem with the radius as the hypotenuse and the distance as one of the legs we solve for the other leg. I have the owner submit expense reports with receipts attached to get reimbursed for business expenses made with personal funds. Take A Sneak Peak At The Movies Coming Out This Week 812 Minneapolis-St.

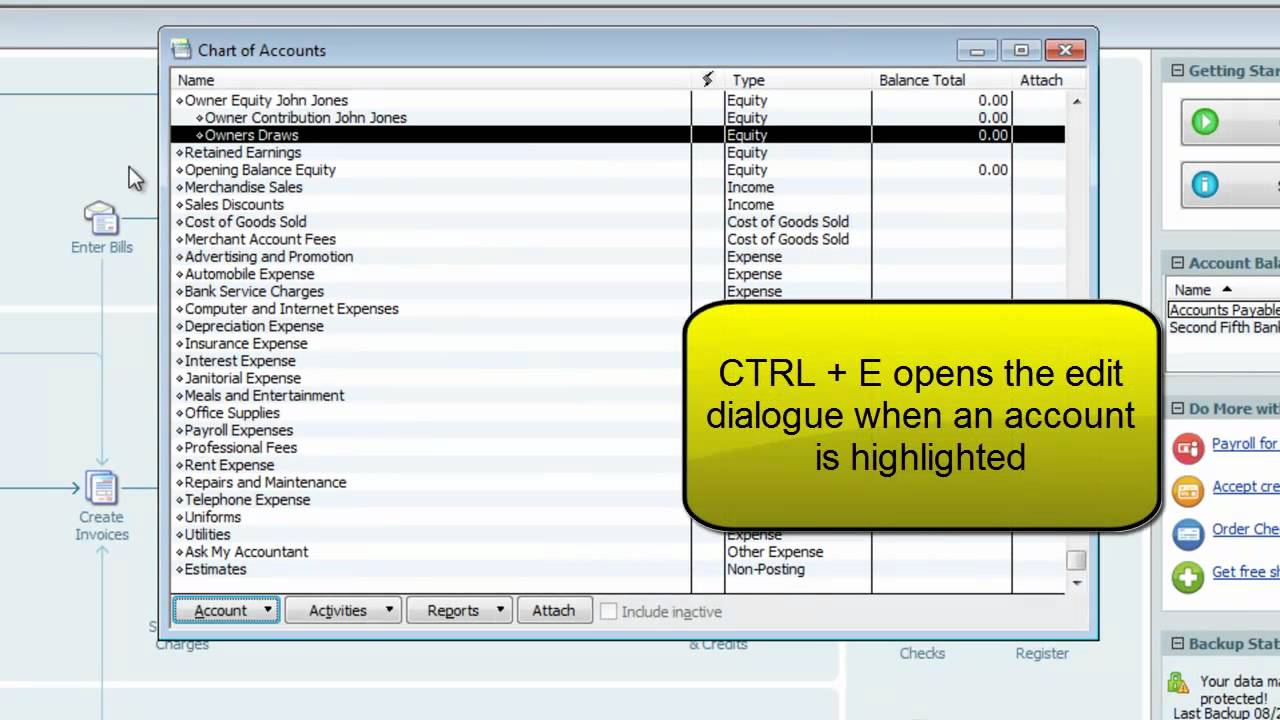

How To Setup And Use Owners Equity In Quickbooks Pro Youtube

Solved Owner S Draw On Self Employed Qb

Owners Draw Setup Quickbooks Create Setting Up Owner S Draw Account Qb

Solved Am I Entering Owner S Draw Correctly

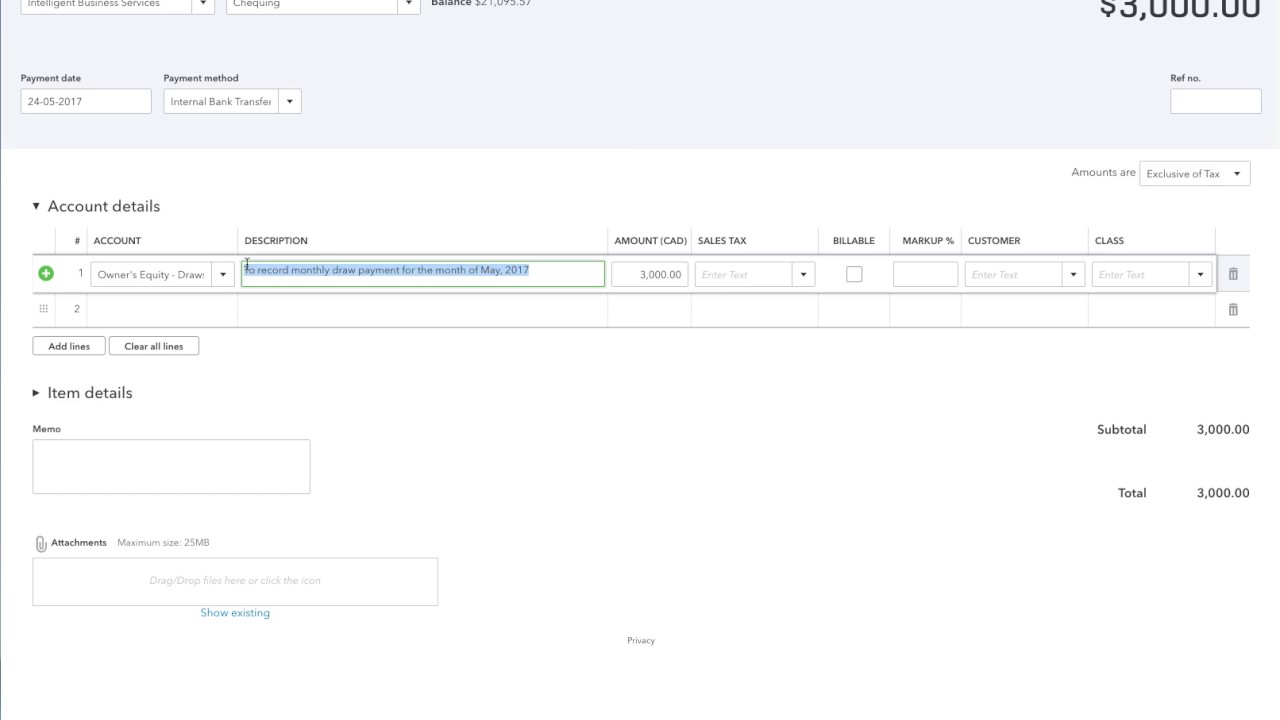

Learn How To Record Owner Investment In Quickbooks Easily

Owner S Draw Quickbooks Tutorial

How To Set Up Owners Draw In Quickbooks Guide Smb Accountants

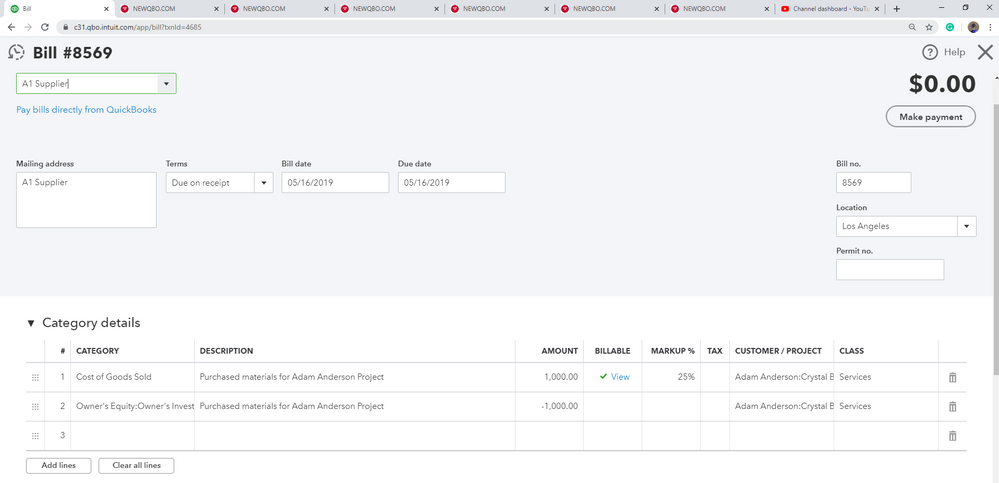

How Do I Make A J E With A Cr To Owner S Draw And Properly Record It In Cog Sold I Am Using Qbo Adv I Bought Items With My Personal Money That

Quickbooks And Owner Drawing Youtube

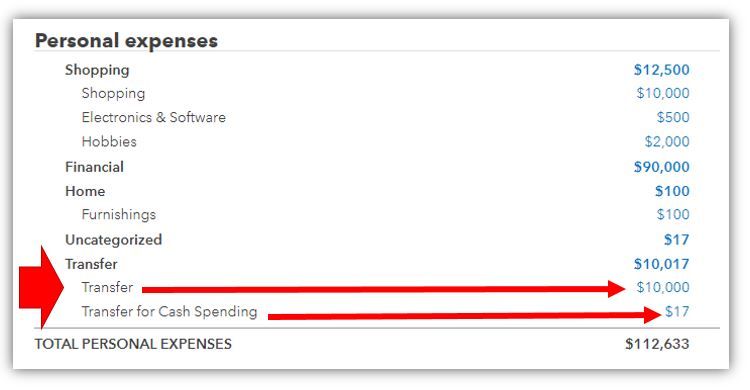

Solved Owner S Draw On Self Employed Qb

How To Record An Owner S Draw The Yarny Bookkeeper

How To Pay Invoices Using Owner S Draw

How To Pay Invoices Using Owner S Draw

How Do I Pay Myself Owner Draw Using Direct Deposi

Quickbooks Owner Draws Contributions Youtube

How To Record Owner S Equity Draws In Quickbooks Online Youtube